Sachin H. Jain posted the following on LinkedIn:

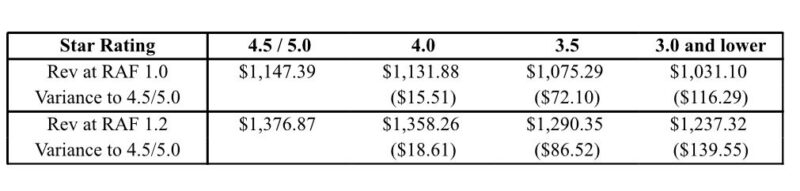

“These numbers are a few years old, but they help illustrate the difference in revenue between highly-rated Medicare Advantage plans and plans with lower ratings.

And how these lower revenue numbers translate into lower payments to risk/value-based providers.

For a patient with a few co-morbidities and a RAF of 1.2, the difference between a 3 STAR rated plan and a 4.5 STAR rated plan is almost $140 in premium payments every month. Annually this adds up to almost $1500 / year premium difference.

If a medical group is in a risk-based contract (with a guaranteed percentage of premium–let’s just say 85% for illustrative payments), this difference in revenue is $1275 annually.

Which brings to mind the question—why are risk-bearing medical groups partnered with low-rated plans that pay them lower revenue?

The answer is an acronym I learned in business school: FOMO: Fear of Missing Out.

Plans are loathe to miss out on incremental membership from enrollment in low-rated plans.

So they partner with multiple plans and get some blend of members from low-rated plans and high-rated plans.

Which works….until it doesn’t.

Over time, growth in low-rated plans fails to cover cost of delivering healthcare.

Hence some of the complaints from medical groups that Medicare Advantage isn’t paying the bills.

What should risk-bearing medical groups do in a year when many plans are experiencing massive drops in STAR ratings that will lead to lower payments to providers in 2026.

For one thing; they should freeze enrollment in low-rated plans.

Why grow with plans that promise to pay you less over time because their revenues are lower?

It makes no sense.

More significantly, they might also consider terminating relationships with perpetually low-rated plans because, well, the membership is more likely to stay with the medical group than the plan.

And it gives the member the opportunity to enroll in a higher-rated plan which is likely to have better and more stable benefits over the long-run on account of higher payments.

If a medical group had 20,000 Medicare Advantage members like I described and was in a risk-based contract that pays it a percentage of premium, the migrated members would draw over $25.5M in additional payments to the provider group.

Short story: by staying partnered with perpetually low-performing plans, medical groups are leaving serious revenue on the table.

And while I’m at it—I encourage medical groups to look at whether some of these low-rated plans (and some high-rated ones) are transparently charging the cost of supplemental benefits (i.e. part B rebates) to you.

While these benefits drive growth—they are often (non-transparently) at the expense of the medical group bottom line.

And over time, these rich benefits are unsustainable because they are literally taking money out of the pockets of provider groups to pay for them.

So beware. And partner with plans whose robust revenues and benefit design translate into higher payments.”

Sachin H. Jain is the President and CEO of SCAN Group and Health Plan and an Adjunct Professor of Medicine at Stanford University School of Medicine. He also serves as a Board Member at The Paul & Daisy Soros Fellowships for New Americans, an Academic Hospitalist (WOC) at the U.S. Department of Veterans Affairs, and a Board Member at America’s Health Insurance Plans (AHIP). He is also a board member of Omada Health.