Marilyn Heine, Physician Leader at Pennsylvania Medical Society, shared on X:

“New AMA report analyzes the pharmacy benefit manager (PBM) market concentration and its impact.

The report reviews the structure of the PBM industry, its deep ties to insurers, low level of competition, and high level of vertical integration.

AMA reports on the 10 largest PBMs and drug insurers nationally, summarizes concentration levels (HHIs) in their markets, and describes the extent of vertical integration of insurers with PBMs.

With low competition and high consolidation, patients could face higher costs and lower choices.

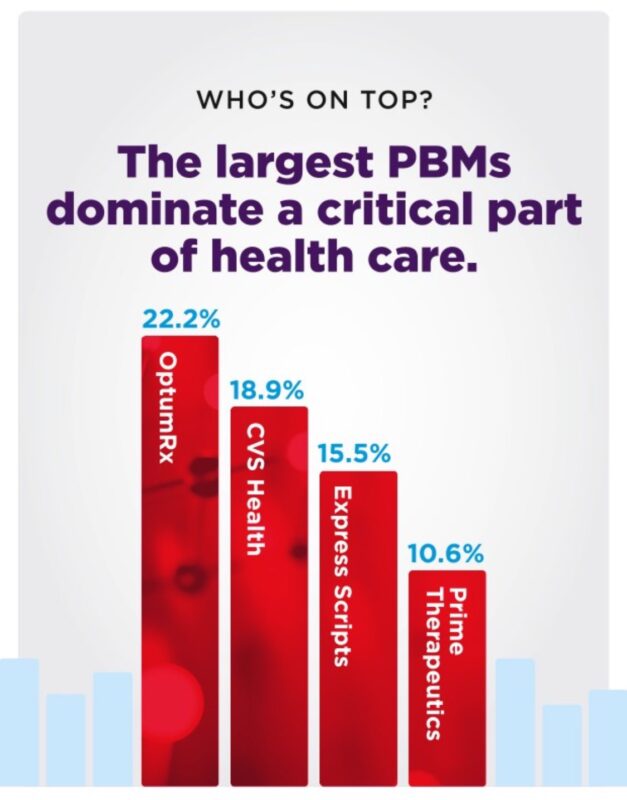

The largest PBMs dominate a critical part of health care.

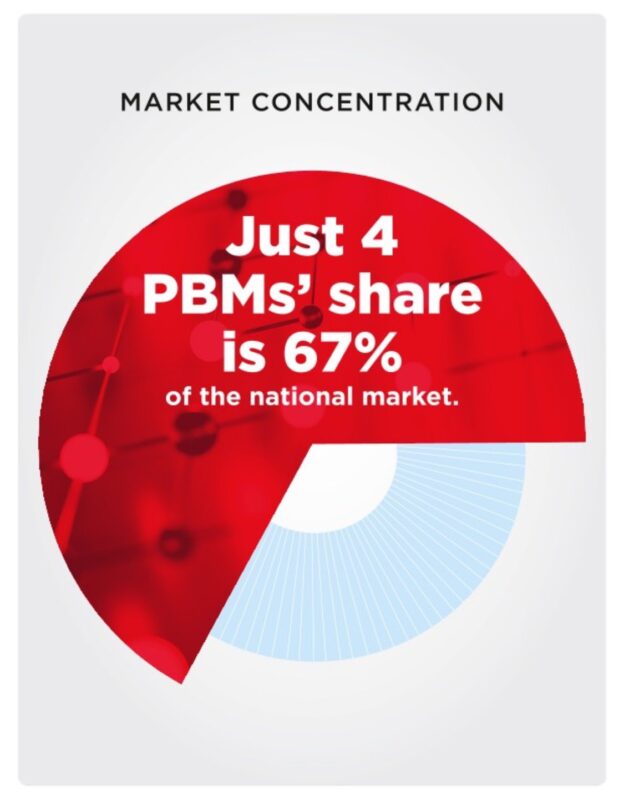

The 4 largest PBMs have a collective national market share of 67%.

OptumRx is the largest PBM (22.2% market share), followed by CVS Health (18.9%), Express Scripts (15.5%), and Prime Therapeutics (10.6%).

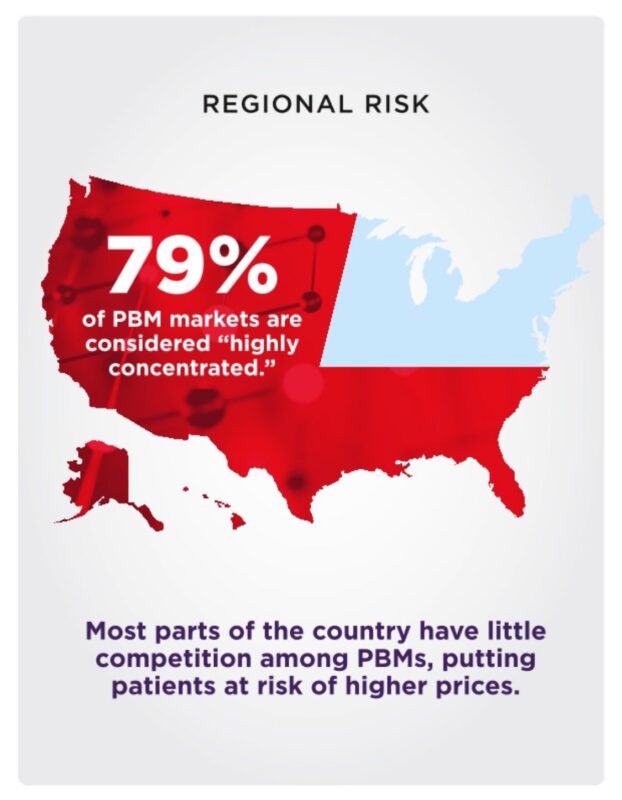

Most parts of the country have little competition among PBMs, putting patients at risk of higher prices.

79% of PBM markets (measured at the PDP region level) are highly concentrated (HHI>1800), based on the 2023 Merger Guidelines.

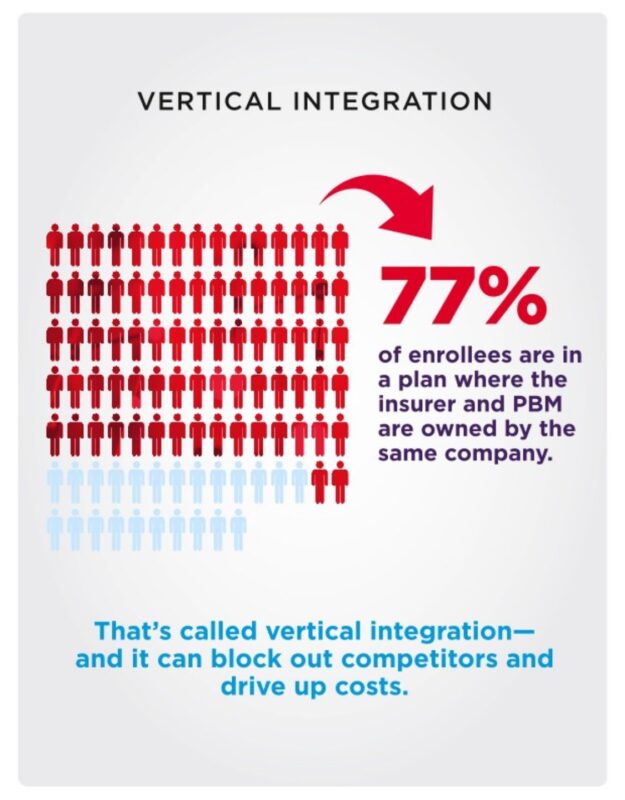

Vertical integration can block out competitors and drive up costs.

Nationally, 77% of drug lives are with an insurer that is vertically integrated with a PBM.

The line between insurers and PBMs is all but erased-that’s not good for competition or patient care.

9 of the 10 largest PBMs share ownership with health insurers.

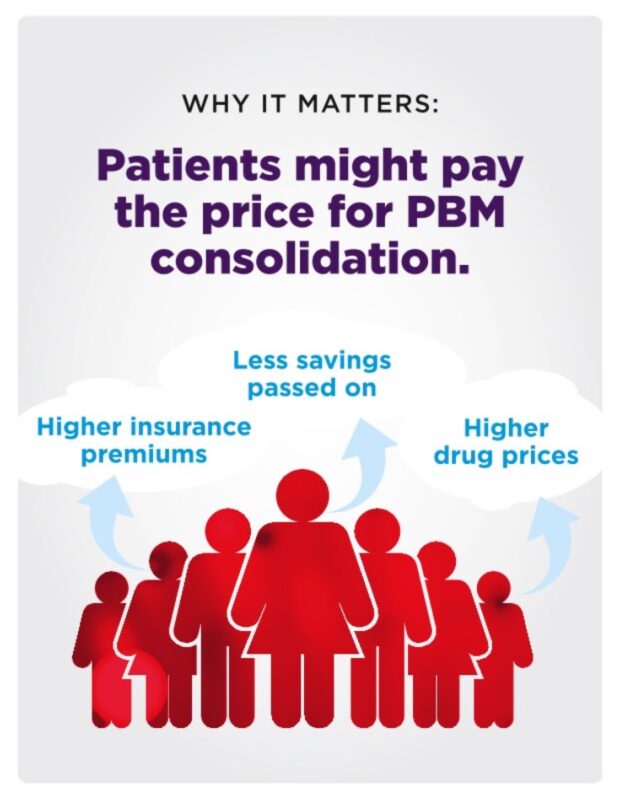

Patients might pay for PBM consolidation:

- low savings passed on to consumers

- high insurance premiums

- high drug prices

- low reimbursement to pharmacies

Extensive vertical integration of insurers/PBMs may cause non-affiliated insurers to lose access to PBMs, low patient choice.

The findings raise questions regarding proposed or consummated mergers…

- among PBMs

and

- between insurers and PBMs

Should the mergers, or should they have, raised antitrust concerns to ensure patients’ affordable access to prescription drugs?…

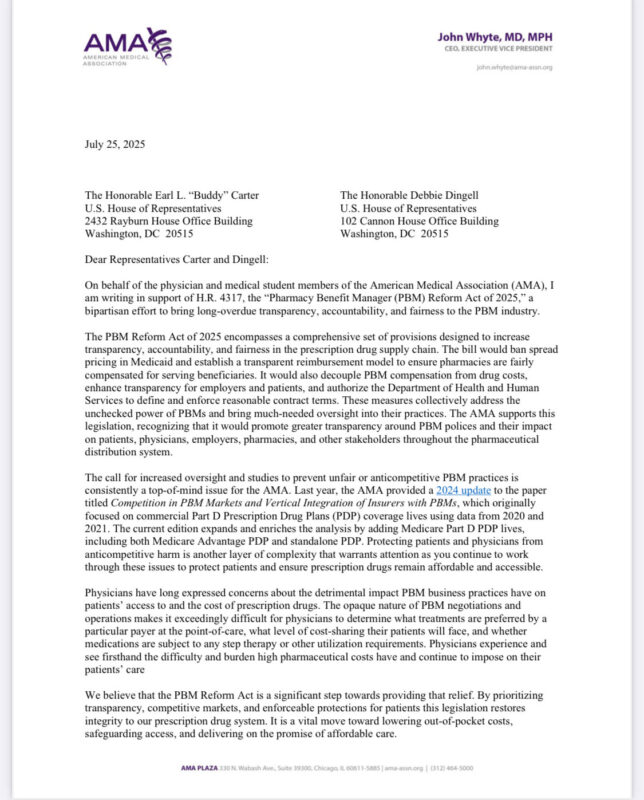

American Medical Association (AMA) letter in support of HR 4317, ‘Pharmacy Benefit Manager (PBM) Reform Act of 2025,’ a bipartisan effort intro by Buddy Carter, Debbie Dingell to bring long-overdue transparency, accountability, and fairness to the PBM industry.”

You can find more posts featuring Marilyn Heine on OncoDaily.