Andrew Pannu, Founder of Sleuth, shared a post on X:

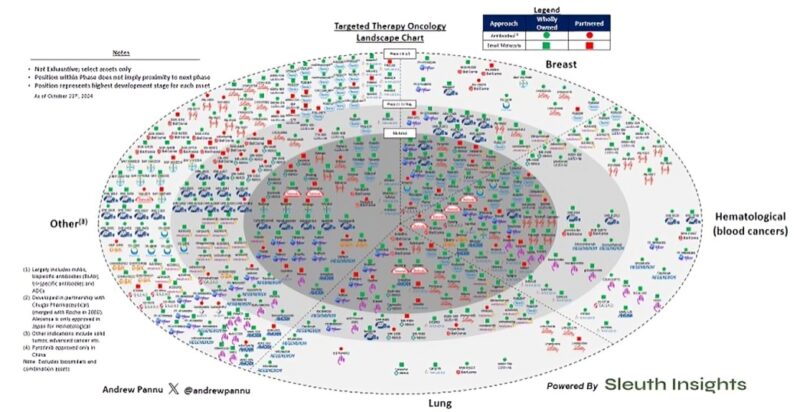

“Competitive landscape for targeted therapies in oncology (TO) 425 assets across 19 pharma companies, segmented by tumor type, phase of development, modality and ownership.”

“TO includes drugs designed to treat cancer with a specific driver mutation, most often requiring patients to take a specific companion diagnostic test to confirm eligibility. ~50% of all cancers have a potential driver mutation and ~30% of these have an approved drug (Source: GS)”

“TO drugs are traditionally associated with small molecules, but this analysis uses the term in a broader context, encompassing antibody biologics (i.e. CKIs, mAbs, ADCs, etc.) as well to show a more picture of active development across Pharma pipelines.”

“This is a mature market, with 147 marketed assets (~35% of the total) represented here alone. The rest by dev stage: Ph 1/2 (172 assets, ~40%), Ph 2 (58 assets, ~14%) and Ph 3 (48 assets, ~11%).”

“The vast majority of assets are wholly owned: 337 or ~79%.

The only companies with primarily partnered assets are Merck (~61%) and Sanofi (~75%) The overall split between biologics and small molecules here is roughly even (~48% vs ~52% respectively).”

“Sales for small molecule TO drugs are >$30B globally, with ’26E estimates at >$40B (although historically, these have been overly optimistic).

Antibodies are on a different scale – global sales for the class exceed $100B, with Keytruda alone anticipated to reach $30B by 2028.”

“As the space has evolved, we’ve seen a few recurring themes: • The initial playbook was finding a validated target and getting to market as fast as possible, oftentimes via the FDA’s accelerated approval pathway (showing impressive ORR in a Phase 2 with maximum tolerated dose).”

“FDA reforms around the AA pathway (i.e. getting tougher on starting an RCT), Project Optimus (dosing) + kinase targets getting picked over have changed this. Innovation has shifted towards higher risk, higher reward plays: less validated targets, drugging approaches and technology.”

“Examples include Amgen’s Lumakras and Mirati’s Adagrasib (KRAS G12C) or novel approaches within ADCS or bispecific antibodies • The space is overall incredibly competitive. Emblematic of broader crowding across the industry, nearly every target / approach has H2H data.”

“Lastly, a lot of initial acquisitions in this space (i.e. Lilly / Loxo, Pfizer / Array) were done on overly optimistic forecasts that later saw significant downward revisions.

M and A had been slow, but perhaps now reversing, headlined by BMS / Mirati earlier this year ($5.8B).”

“That’s all – if you found this insightful, follow for more biotech charts, musings and breakdowns Analysis powered by Sleuth.”

Andrew Pannu is the Founder of Sleuth. Previously, he was the Senior Manager of Corporate Development and Business Development Associate at Immunai. He has also been an Investment Banking Analyst at the Deutsche Bank.