Dora Vallejo – Ardila, Senior Medical Monitor/ Clinical Research Physician at Avance Clinical, shared a post on LinkedIn:

“Strategic Learnings for Oncology Biotech in Australia: Multi-Indication Strategy Compounds Advantages Down Under

The latest news: ‘The PBAC recommended a multi-indication (broad) listing for nivolumab and ipilimumab in advanced or metastatic cancers. The PBAC considered the revised proposal put forward by the sponsor addressed its concerns, particularly in ensuring the financial risk was acceptably contained within the proposed risk-sharing arrangement.’

What does it mean?

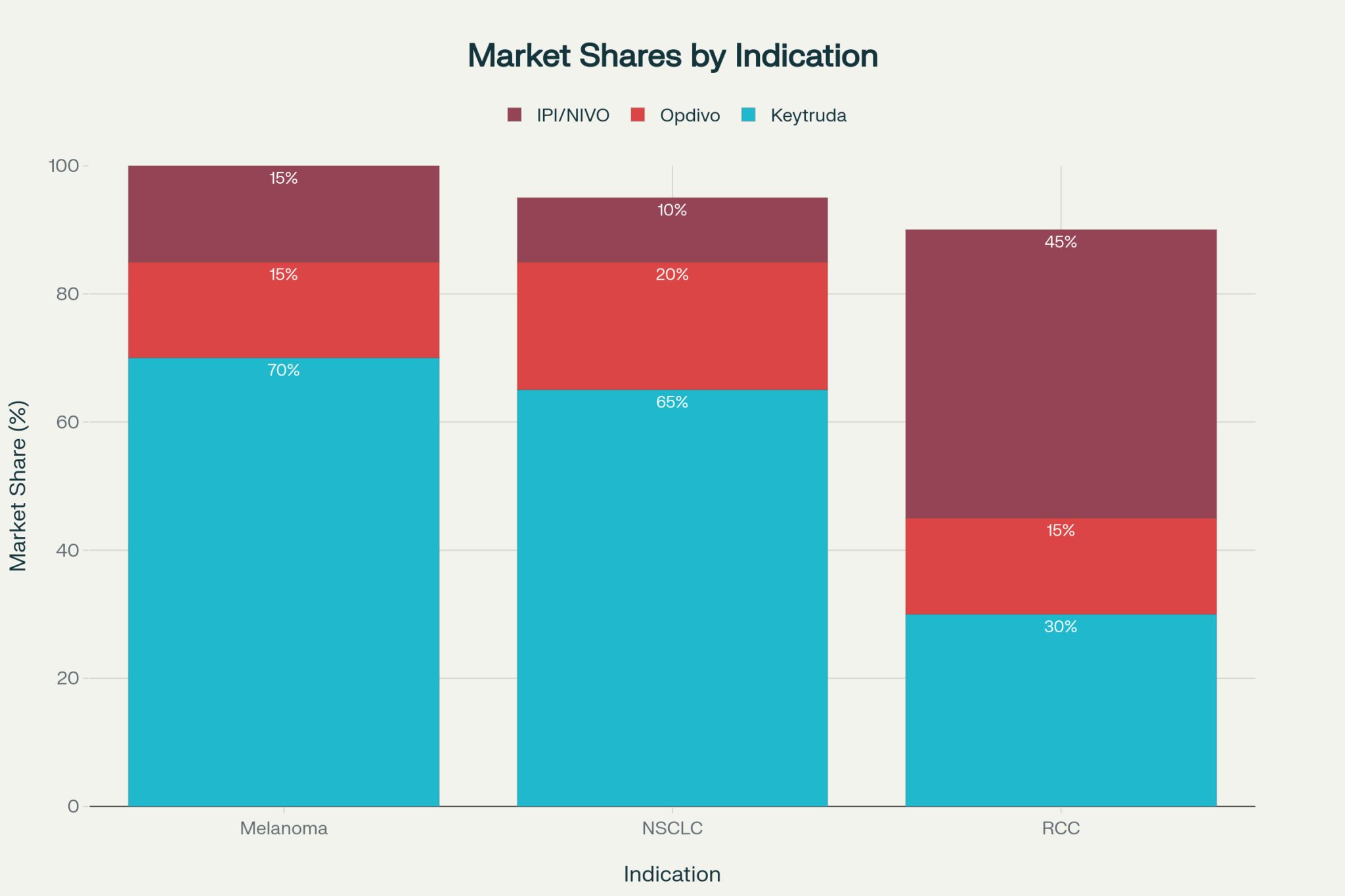

- First-Mover Advantage Quantification: Keytruda’s 3.6-month melanoma lead translated to 70% vs 15% market share split—a 55 percentage point advantage. This exceeds the base FMA model prediction (≈6 percentage points for 3.6 months), indicating compounding effects from indication expansion and prescriber lock-in.

– Implication: Accelerating launch by 6-12 months justifies substantial R&D investment. - Capabilities Can Override 7-Month Disadvantages: Keytruda’s NSCLC success despite 7-month lag demonstrates that strategic execution(combination approvals, lifecycle management) creates capability advantages that overcome modest timing gaps.

– Implication: Small/mid-sized biotechs launching 6-12 months behind should partner with large pharma immediately rather than attempt independent competition. - Clinical Superiority Overcomes 29-Month Delays

IPI/NIVO’s 45% RCC share despite 29-month disadvantage proves that differentiated clinical benefit (demonstrated in CheckMate 214 with HR 0.63) can establish dominant Nash equilibrium even with significant timing deficits.

– Implication: Late-stage programs with superior efficacy should not be abandoned due to competitor leads; clinical differentiation creates sustainable advantages. - Australia’s Regulatory-Reimbursement Gap Delays Equilibrium

The median 16-month TGA-to-PBS delay creates a dual-stage competition: TGA approval establishes clinical positioning, but PBS listing determines actual market access.

– Implication: Plan 12-18 month PBAC negotiation into Australian launch timelines; budget for extended pre-revenue period and prioritize markets with faster reimbursement (USA, Germany) for initial launches. - Indication-Specific Dynamics Require Tailored Strategies

Melanoma: Timing-driven (first mover dominates)

NSCLC: Capability-driven (strategic execution overcomes delay)

RCC: Efficacy-driven (clinical superiority trumps timing)

– Implication: Conduct indication-specific competitive assessments; launch strategies cannot be genericized across tumor types.”

More posts featuring Dora Vallejo – Ardila.