Andrew Pannu: Pharma Oncology Focuses on Backbones and Modality-Agnostic Combinations

Andrew Pannu, Founder of Sleuth, shared a post on X:

“Biotech leaders – Pharma oncology revolves around backbones and modality-agnostic combos.

Miss this and you’ll misposition your portfolio.

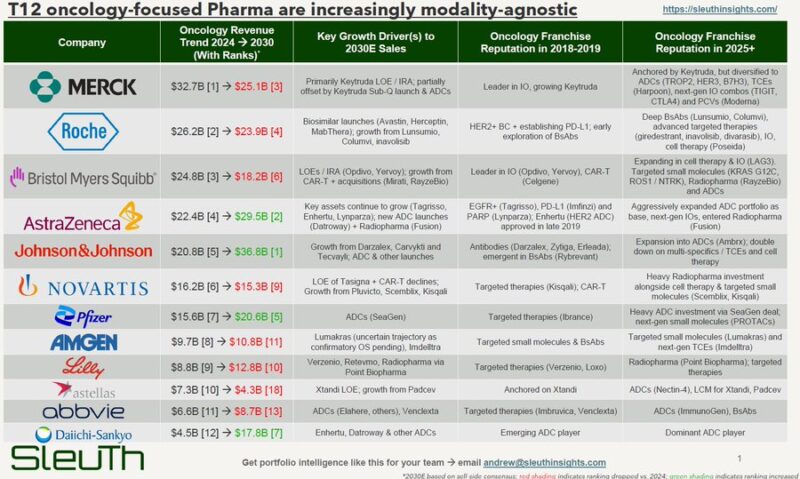

Sleuth AI agents analyzed every major Pharma oncology pipeline over the last few years, tracking modality shifts, combo strategies and deal patterns. A few portfolio strategy principles emerged.

First, the importance of the backbone:

Every cancer treatment generation has a backbone therapy effective across tumors (most recently, PD-L1 inhibitors; in the near future, perhaps PD-L1 x VEGF – which explains the deal flurry here). Pharma must own this internally – it’s table stakes for controlling clinical development destiny.

This explains why every Pharma pursued their own PD-(L)1, despite becoming a meme for inefficient R&D (“do we really need another..”). It doesn’t matter if the drug sells well, without it, you’re at the mercy of partners for combo development.

And that’s the key: growth comes from smart, synergistic combo plays on top of backbones. And Pharma’s betting on modality-agnostic approaches to get there.

Almost 5 years ago, most Pharma pipelines had 1-2 modalities per company. Today we see ADCs, TCEs, multispecifics, targeted therapies and radioligands all in one portfolio, and all frequently combined.

Platform concentration is too risky. Cell therapy’s decline is cautionary – big infrastructure bets can get leapfrogged by more nimble modalities (i.e. BsAbs) that offer similar or superior efficacy, cleaner manufacturing and modular combo potential.

The new playbook is modality flexibility plus tumor-specific expertise. For Pharma, the goal is 1L treatment ownership in large patient populations. The mandate is to get there by any means necessary (modality-agnostic). And in a post-IRA world with exclusivity clocks starting at 1st indication, you can’t just build up from late-line approvals in smaller indications.

Branding around a large, specific tumor means:

• ROI to commit multiple shots on goal

• Compounding KOL / PI / provider / patient relationships for efficient trial execution

• Flexibility to pivot modalities as needed

For biotech leaders, 3 critical positioning strategies:

1. Lead with combo rationale. Don’t pitch standalone assets. Show exactly how you enhance their backbone strategies.

2. Map to tumor franchises. Understand which Pharma are investing in your tumors so you can position as the missing piece (Sleuth maps this for you)

3. Design around future backbones. Synergistic data here can transform a BD process.

If you’re developing oncology assets and want to see how your portfolio maps against Pharma’s evolving strategies, DM me! Our AI platform tracks every pipeline globally to spot strategic gaps before your competitors do.”

More Posts Featuring Andrew Pannu.

-

Challenging the Status Quo in Colorectal Cancer 2024

December 6-8, 2024

-

ESMO 2024 Congress

September 13-17, 2024

-

ASCO Annual Meeting

May 30 - June 4, 2024

-

Yvonne Award 2024

May 31, 2024

-

OncoThon 2024, Online

Feb. 15, 2024

-

Global Summit on War & Cancer 2023, Online

Dec. 14-16, 2023