Vincent Ling: Where does the money go?

Vincent Ling, Chief Business Officer at Morphocell Technologies, shared a post on LinkedIn by Aquiba Benarroch, Founder of Q1 Labs, adding:

“Where does the money go? Banarroch details how the public might not appreciate the risk structure if one were to invest in Summit Therapeutics.

Summit made headline news a few months back with positive clinical results with their new antibody. This event sparked the new hot buzz that the well of innovation has shifted to China, echoed around JPM last month.

Benarroch reveals that there are two entities involved with the therapy, Akeso and Summit, and the upfront payments predominantly went to Akeso.

He suggests that Akeso shareholders have already profited on the deal regardless of clinical success in repeat trials in the US.

Interesting read.”

Quoting Aquiba Benarroch’s post:

“Billionaire Bob Duggan has wagered $500M on a Chinese cancer drug. Now it’s worth $14B, but the real story lies in who gets paid even if it fails.

What Happened?

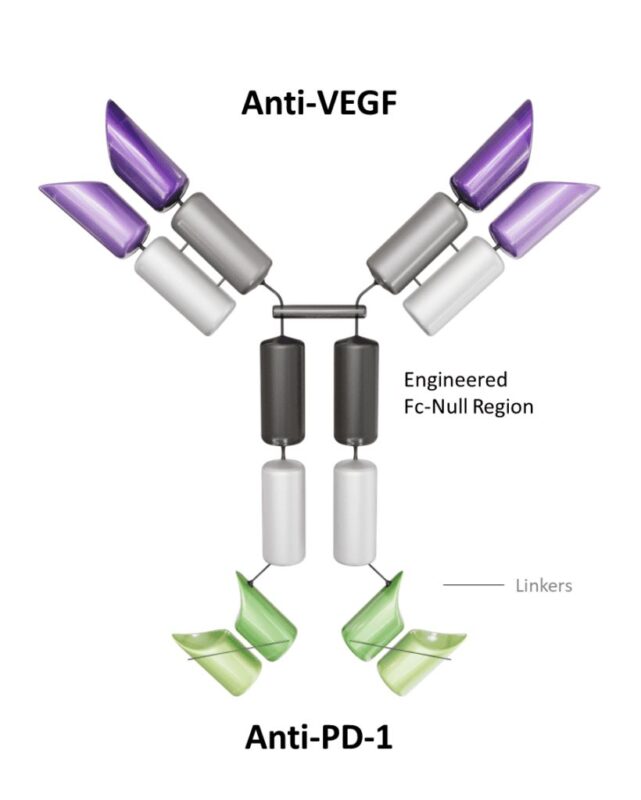

Summit Therapeutics (SMMT) has surged over 320% in the past year, reaching a $14B market cap with zero revenues, driven by positive Phase III results of ivonescimab, a new lung cancer drug.

Hidden Risk:

SEC filings reveal an asymmetric risk structure where Akeso the Chinese developer of ivonescimab, has secured both significant upfront cash ($475M), retain royalty rights and hold 5% ownership in SMMT through its Founder Michelle Xia’s board position.

Why It Matters:

While SMMT shareholders bear the full risk of FDA approval, Akeso has positioned itself for success regardless of outcome. The valuation disconnect between SMMT (+320%) and Akeso (+43%) over the last year suggests the market may be missing this risk.

Context:

Biotech valuations often hinge on binary outcomes like FDA approvals.

However, SMMT’s situation is unique due to:

- A highly concentrated ownership structure (insiders own 88% of shares outstanding),

- A complex financial relationship with Akeso,

- An asymmetric risk profile where the limited public float may understate the actual market risk associated with ivonescimab’s future prospects.

I develop tools to quickly identify red flags like this one. Message me to learn more.”

-

ESMO 2024 Congress

September 13-17, 2024

-

ASCO Annual Meeting

May 30 - June 4, 2024

-

Yvonne Award 2024

May 31, 2024

-

OncoThon 2024, Online

Feb. 15, 2024

-

Global Summit on War & Cancer 2023, Online

Dec. 14-16, 2023