Andrew Pannu, Founder of Sleuth, shared a post on X:

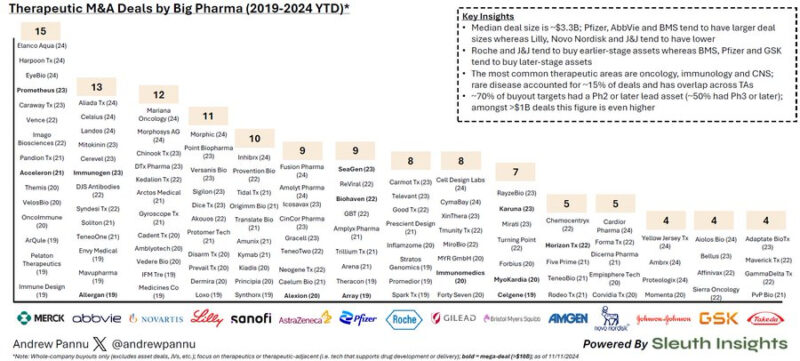

“Analysis of Big Pharma Therapeutic M&A Deals from 2019 to today

Some takeaways:

• M&A tends to pick up as company’s approach big LOEs, and so unsurprisingly, Merck and AbbVie led the way.

For Merck, they’re facing a $30B LOE in 2028 with Keytruda – big bets on Acceleron ($11.5B) and Prometheus ($10.8B) + several mid-sized deals are attempts to plug that. They’ve indicated they’re still in the market for more deals, so this probably doesn’t slow down either.

AbbVie is a few years ahead, having just gone through this process with the $21B Humira LOE in 2023.

• Every management team has their own style with the types of buyouts they prefer. Pfizer, AbbVie and BMS tend to take big bets, with much higher average deal sizes. In contrast, Lilly, Novo Nordisk and J&J tend to be much lower. With those larger $, Pfizer and BMS tend to acquire companies with more developed lead assets, usually Phase 3 or beyond. J&J and Roche tend to be the opposite, acquiring companies earlier on. Everyone else falls somewhere in the middle (including AbbVie, interestingly).

However, given the modest N, a few deals can shift these averages dramatically Overall, the vast majority of deals had at least a Ph2 asset. For >$1B deals or public market buyouts, ~70% had a Ph3 lead asset or later. Pharma pays up for guaranteed near-term revenue

• The usual therapeutic areas are top of the list for most buyouts: oncology, I&I and CNS. About ~15% of deals involved assets targeting rare diseases. CV / Metabolic is also a favorite, especially recent deals around obesity-related plays. Pharma has a strong commercial engine in all of these areas (reps, relationships, learnings). One of the best things they can do is to keep feeding that engine new, differentiated assets • With the caveat of the style differences above, most companies do mid-size deals in the $1-5B range.

If they do a mega buyout, they’re usually less active in subsequent years as the focus shifts towards integration We’ve seen ~$30B in deal flow YTD which is well below 2023 ($110B) and 2022 ($66B), but total deal count is actually above the historical average. $ sizes are driven by outlier mega-deals, and we’ve just seen fewer large transactions this year as companies reset Let me know of any other takeaways you had below or if you’d like a PDF!

All analysis powered by Sleuth.”