Tanja Obradovic

Apr 25, 2025, 20:03

Tanja Obradovic: Pharmaceutical innovation in oncology during economic unknowns and challenge to do better

Tanja Obradovic, Oncology Medical Strategy Advisor at Mercurial AI, shared a post on LinkedIn:

“Pharmaceutical innovation in oncology during economic unknowns and challenge to do better. Oncology attracts significant Pharma R&D investment, with 37% all pipeline assets compared to all other therapeutic areas according to latest Deloitte report. In 2024 oncology assets also ranked as highest contributors to revenue growth to top 20 Pharma companies standing at 26% compared to next ranked obesity with 16%.

Obviously success of oncology drugs development is critical for the bottom line. In general, few aspects of interest for that bottom line. R&D returns for 2024 rose to 5.9% for the top 20 biopharma companies, up from about 4% the year before but considering impact of the current business environment where that % falls in 2025 is uncertain. To continue upwards trajectory or remain at the 2024 level, outcome will be critically affected by decisions around pipeline decision making, prioritization, M&A activity, and adoption of new technologies such as AI advances.

All these are critical to support innovation. And innovation matters when it comes to ROI. While novel and fast-follower new molecular entities with new mechanism of action (new MOA) represent average of 23.5 % of all developed drugs during last 4 years, their forecast revenue share contribution is a much larger % with a four-year-average of 37.3 %.

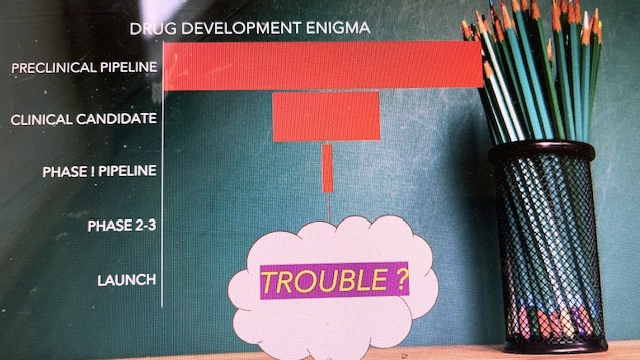

For oncology therapeutic area drug development faces high risks with high costs and low success in reaching market. Especially success rates of drugs entering clinical development space and those passing gate of Phase I where decision making, and use of advanced tools have potential to make a large impact.

Not only at these pain points but across development continuum larger departmental and functional connectivity within and outside of organization, deep therapeutic business and project strategy acumen, advanced analytics and predictive modeling to guide Go/No-Go decisions, pipeline and program prioritization, internal investment and M&A moves based on disciplined risk assessment, should result in more efficient and targeted drug development, reduced development costs, and improved chances of regulatory and market access success.

These are especially needed in current times of economic uncertainty and increasing value of R&D spend. When it comes to M&A, Biotech companies are becoming extended arms of R&D development for Large and Mid-size Pharma especially in oncology considering number of recent deals and emerging innovation outside of developed markets.

Even under less strenuous investment situation than the current one, trends in the past few years call for improvement in decision making beyond focusing on more mature Phase II-ready assets as proportion of terminated assets developed either internally or externally is relatively similar during 2023-2024 with slightly better picture for external assets at 12% terminated vs 14% internally developed assets halted in 2024 (11% external and 13% internal in 2023).

From the business perspective, definitively a lot to keep in mind as we get closer to AACR2025 start where many Biotech companies will showcase pipelines. Large, late-stage acquisitions while capable of moving significantly mature pipeline and marketed portfolio bring need for higher investment and therefore higher risk while more nimble earlier technologies if developed with high scrutiny and limited investment risk look better fitted for the current state of the market and can deliver long term transformative gains.”

More posts featuring Tanja Obradovic.

-

Challenging the Status Quo in Colorectal Cancer 2024

December 6-8, 2024

-

ESMO 2024 Congress

September 13-17, 2024

-

ASCO Annual Meeting

May 30 - June 4, 2024

-

Yvonne Award 2024

May 31, 2024

-

OncoThon 2024, Online

Feb. 15, 2024

-

Global Summit on War & Cancer 2023, Online

Dec. 14-16, 2023

Sep 2, 2025, 22:37

Sep 2, 2025, 22:03

Sep 2, 2025, 20:50

Sep 2, 2025, 18:53

Sep 2, 2025, 16:54