Soleil Shah: Widespread acquisitions of medical practices by insurers

Soleil Shah, Resident Physician at Brigham and Women’s Hospital, shared on X:

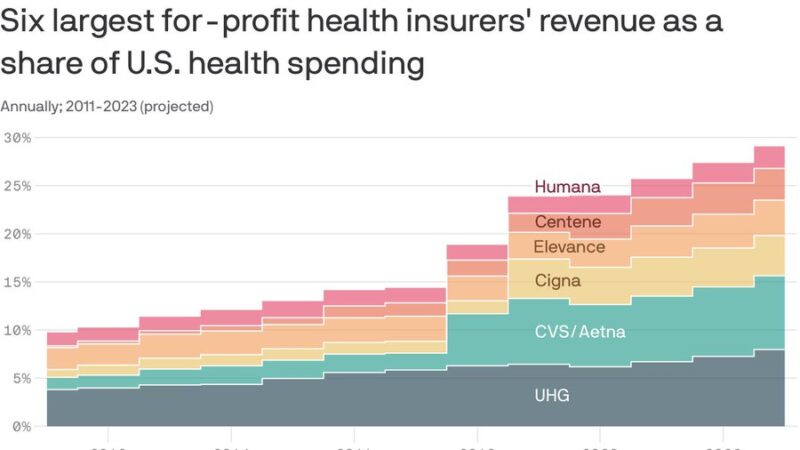

“Our new paper in NEJM examines the widespread acquisitions of medical practices by UnitedHealth, Humana, Cigna, and other insurers—what’s driving this trend and what are its implications for patients and clinicians?

In the past decade, health insurers have gained significant control over care delivery: UnitedHealth is the largest employer of physicians, Humana leads in senior-focused primary care, and Aetna, owned by CVS, is linked to the nation’s largest PBM.

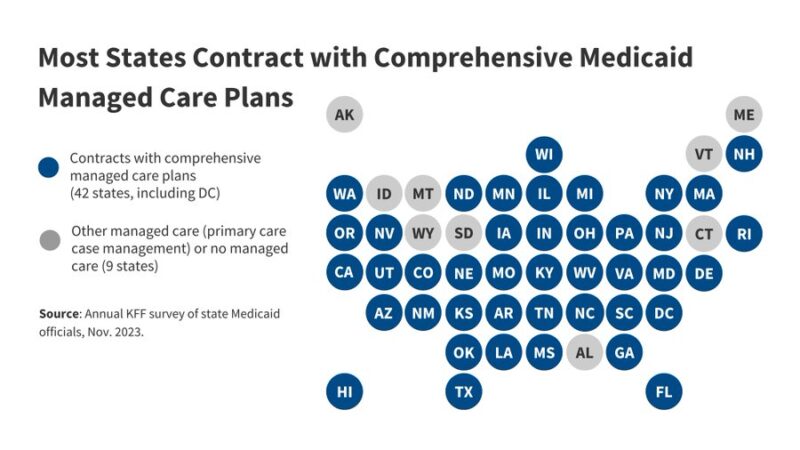

Partly financing these ongoing insurer acquisitions are increasing government payouts. Private health insurers are expected to receive ~$1 trillion in 2024 to cover beneficiaries in Medicare Advantage and Medicaid managed care.

With this capital, private health insurers can purchase medical practices and ‘supply-side’ companies to 1) maximize captivated revenue from government and 2) reduce costs through ‘intercompany eliminations.’ See Bob Herman’s helpful piece.

Some potential upside to this trend. Since insurers care about how much they spend on their beneficiaries, their acquired practices *may* have more incentives to prevent costly ED visits and hospitalizations than hospital-owned or private-equity owned practices…

Potential actions for regulators to curtail insurance consolidation harms = reducing MA overpayments, boosting enforcement power of U.S. Department of Justice and FTC, strengthening MLR laws. See Hayden Rooke-Ley‘s solution-filled report in

Read further.

Source: Soleil Shah/X

-

Challenging the Status Quo in Colorectal Cancer 2024

December 6-8, 2024

-

ESMO 2024 Congress

September 13-17, 2024

-

ASCO Annual Meeting

May 30 - June 4, 2024

-

Yvonne Award 2024

May 31, 2024

-

OncoThon 2024, Online

Feb. 15, 2024

-

Global Summit on War & Cancer 2023, Online

Dec. 14-16, 2023